| Pre Conference Workshop – Lead Resource Persons | |

|

|

| Mr. S. N. Ananthasubramanian Senior Partner of S N ANANTHASUBRAMANIAN & CO., Company Secretaries Mumbai |

Dr. Krishna Prasanna P Associate Professor Department of Management Studies, IIT Madras |

|

|

|

|

|

| Dr.Durga Prasad Samantaray Associate Professor-Finance, College of Business Administration, King Saud University, Saudi Arabia |

Ms.Sneh Thakur Headi-Credit and Collections, Ujjivan Small Finance Bank |

|

Conference Speakers |

|

| Keynote Speaker – Inaugural | Distinguished Speaker – Inaugural Session |

Mr.Viju Parameshwar Former President & CEO, Kluber Lubrication India Private ltd, Bangalore Topic: The Role and Structure of CFO in a Manufacturing Company |

Mr. Kesavan Venugopalan Group Chief Financial Officer Narayana Health Topic: Finance… A Long Haul |

|

Distinguished Speaker -Valedictory Function |

|

Dr.Prasanna Chandra Director-Centre for Financial Management, Bangalore Topic: ‘Nonscientific Perspectives on Finance |

|

|

Invited Speakers |

|

|

|

| Mr. Swaminathan Santhanam Independent IT Solutions Consultant Topic: Digital Transformation in Organizations |

Mr.Manoj Pasangha Senior Vice President & Zonal Business Head, Bharat Financial Inclusion Limited Topic: Challenges and Opportunities for Micro Finance Industry in the Changing Landscape of the Country |

|

|

|

|

|

| Mr.Sanjay Somasundara Deputy Vice President-Tamil Nadu Kotak Mahindra Life Topic: Life Insurance Industry over the last decade and Current Trends |

Mr. Pavan Kumar Kopparam AVP – Investment Advisory Entrust Family Office Topic: Lessons from Global Financial Crisis |

About the Conference

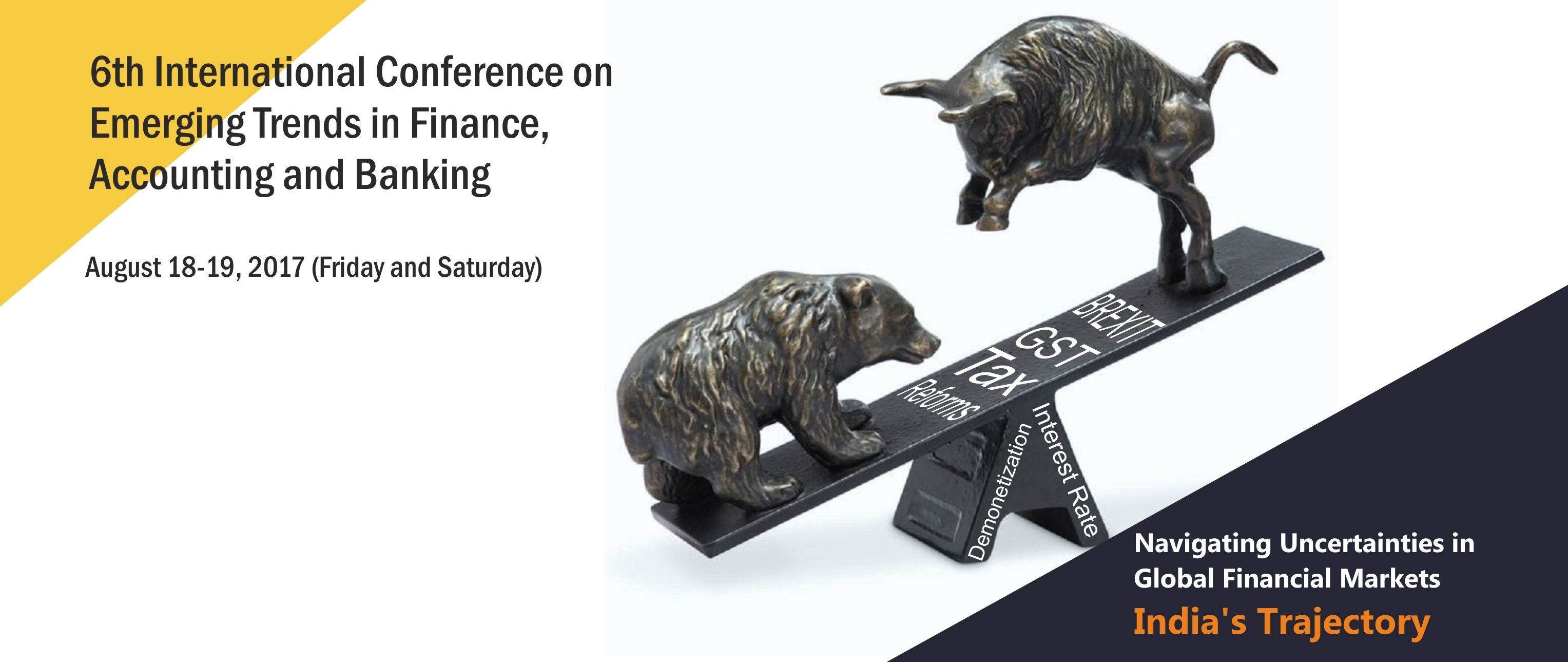

The capital markets are set for turbulent times as the recent developments in the global financial markets might have ramifications that could erode the fortunes of emerging markets. The good news though is that the Indian economy is set to bear the lesser brunt of the impact of the happenings in global markets. Global developments coupled with the recent happenings in the domestic market have reinforced efforts to draw a roadmap for markets to navigate the uncertainties. The recovery of U.S market could trigger a hike in interest rates; likewise, changes in the global policies of the new administration in the U.S and the exit of U.K from the European Union could have ripple effects across the globe in terms of trade wars.

Despite all these odds stacked against it, the GDP in India is expected to grow in the range of 6.5%-7.25%. The fastest growing economy in the world is poised to remain at the epicentre of all investing activities.

A slew of measures led by the government in bringing up transparency in operations, efforts to eradicate black money, policies providing a fillip to new start-ups and MSMEs, impetus to infrastructural development and opening up of banking sector are expected to turn the financial pivot firmly in India’s favour.

Overwhelmed with resounding success from the earlier versions of the International conference on Finance and Accounting, SDMIMD takes the pleasure in announcing the 6th International Conference on Emerging Trends in Finance, Accounting and Banking on August 18-19, 2017.

Number of Visitors